Probate in Illinois typically takes 6 to 12 months for a simple, uncontested estate. Estates involving real estate sales, unresolved debts, or family disputes often take 18 to 24 months or longer. The most important factor affecting the timeline is Illinois’ mandatory 6-month creditor claim period, which applies to nearly every probate case and sets a legal minimum on how quickly an estate can close.

Table of Contents

- Illinois Probate Timeline at a Glance

- What is Probate?

- 2025 Illinois Update: Small Estate Affidavit Changes

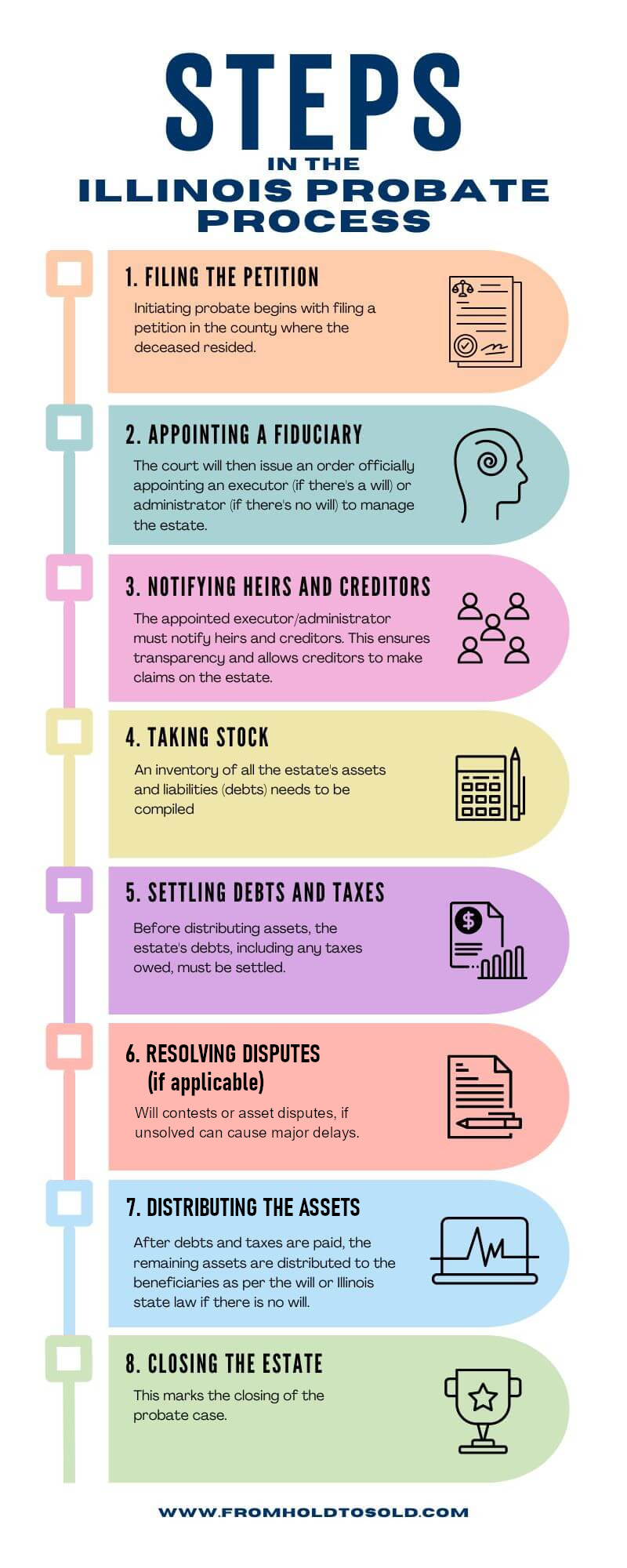

- Step-by-Step Probate Timeline in Illinois

- 1. Filing the Probate Petition (1 to 4 months)

- 2. Appointing an Executor or Administrator

- 3. Notifying Heirs and Creditors (2 to 6 months)

- 4. Inventory and Asset Valuation (2 to 6 months)

- 5. Paying Debts, Taxes, and Expenses (6 to 12 months)

- 6. Resolving Disputes (6+ months to several years, if applicable)

- 7. Distributing Assets & Closing the Estate (1 to 3 months)

- What Usually Causes Delays in the Illinois Probate Process?

- Can Probate Be Completed Faster in Illinois?

- Need to Sell a House During Probate in Illinois?

- FAQs About Probate Timeline in Illinois

- Final Thoughts – How Long Does Probate Take?

Illinois Probate Timeline at a Glance

| Estate Type | Estimated Probate Duration |

|---|---|

| Simple estate, no disputes | 6 to 12 months |

| Moderate estate, some debts | 12 to 18 months |

| Complex estate, disputes | 18 to 24+ months |

Key point: Even organized estates cannot be finalized before the creditor claim period expires, making six months the absolute minimum for formal probate in Illinois.

What is Probate?

Probate is the court-supervised legal process of validating a deceased person’s will, identifying their assets, paying off outstanding debts, and distributing the remaining estate to heirs. In Illinois, this process ensures that all creditors are paid before property officially changes hands.

2025 Illinois Update: Small Estate Affidavit Changes

Before diving into the steps, it is important to note a major change in Illinois law. Effective August 15, 2025, Illinois Public Act 104-0346 updated the Probate Act of 1975 to streamline smaller estates.

What changed:

- The Small Estate Affidavit threshold increased from $100,000 to $150,000

- Illinois-registered motor vehicles are excluded from this limit

What didn’t change:

- The affidavit applies only to personal property

- Real estate still requires probate unless held in a trust or otherwise exempt

Step-by-Step Probate Timeline in Illinois

Realtor Pro Tip: You do not need to wait 12 months to sell the house. In Illinois executors can sell the property as soon as ‘Letters of Office’ are issued to stop paying high property taxes, utilities and insurance.

1. Filing the Probate Petition (1 to 4 months)

The probate process starts when the executor named in the will, or an interested party if there is no will, files a petition with the local county court. The court must validate the will and formally open the estate before any authority is granted.

Why this step takes time:

- Court backlogs can delay initial hearings for weeks to months. This is particularly true in highly populated areas – for instance, the Cook County Probate Division is one of the busiest in the country, often moving slower than DuPage, Lake or the surrounding collar counties.

- If the will is contested, the process can take longer.

2. Appointing an Executor or Administrator

Once you file the petition, the court will appoint a fiduciary – either a probate executor (if there’s a will) or an administrator (if there’s no will). This person is responsible for managing the estate throughout the probate process.

3. Notifying Heirs and Creditors (2 to 6 months)

Once probate is opened, the executor must notify heirs and creditors. Illinois law requires that:

- A legal notice is published in a local newspaper within 2 months.

- Creditors have at least 6 months to submit claims for unpaid debts.

The Mandatory Creditor Period

Under 755 ILCS 5/18-3, Illinois law requires a 6-month window for creditors to file claims. This period begins once the notice is published in a local newspaper.

Why this matters: Final distributions cannot legally occur until this period ends, regardless of how simple the estate may be. This requirement alone explains why most Illinois probate cases last close to a year.

4. Inventory and Asset Valuation (2 to 6 months)

The executor must locate, document, and appraise all assets in the estate, including real estate, bank accounts, investments, valuables, and personal property.

Delays often happen if:

- Financial records are missing.

- Professional appraisals are required (especially for real estate or businesses).

For estates with multiple properties or business assets, this step can add months to the process.

5. Paying Debts, Taxes, and Expenses (6 to 12 months)

Before any beneficiaries receive their inheritance, the estate must:

- Pay valid creditor claims.

- Settle outstanding debts, including mortgages or medical bills.

- File and pay any required state and federal tax returns.

Disputed creditor claims can lead to legal battles and further slow probate and can extend the process by several months to over a year.

6. Resolving Disputes (6+ months to several years, if applicable)

If family members contest the will, disagree on asset distribution, or challenge the executor’s role, probate can take significantly longer.

Common reasons probate takes longer due to disputes:

- Family members contesting the will.

- Disagreements over the executor’s handling of assets.

- Multiple heirs fighting over real estate or personal property.

Disputes can add months or even years to the process.

7. Distributing Assets & Closing the Estate (1 to 3 months)

Once debts are paid, the executor submits a final accounting to the court for approval. After approval, remaining assets are distributed to heirs, and the court officially closes probate.

Delays in this step happen if:

- The court requires additional review or hearings before approving the final distribution.

- The estate includes real estate that must be sold before closing probate.

What Usually Causes Delays in the Illinois Probate Process?

Several common bottlenecks can stretch the timeline to 18 months or more. In our experience working with Illinois families, these are the primary culprits:

- Unsold Real Estate: This is the #1 reason probate cases remain open in Cook, Lake, and DuPage counties. An estate cannot be closed until the property is either sold or legally transferred. If a house is sitting vacant, in disrepair, or struggling to sell on the market, the entire legal process grinds to a halt.

- Court Backlogs: Highly populated areas like Cook County often face significant scheduling delays. It can take weeks, sometimes months, just to get a court date for initial “Letters of Office” or the final discharge.

- Missing or Incomplete Documentation: A single missing signature on a petition or an outdated address for a distant heir can cause a judge to continue the case to a later date, adding 4–8 weeks of delay instantly.

- Challenges to the Will: If an heir contests the validity of the will (citing “undue influence” or “lack of capacity”), the process can move into litigation. This can add years to the timeline and thousands in legal fees.

- Complex Asset Valuation: Estates with businesses, multiple rental properties, or unique collectibles require professional appraisals. In Illinois, coordinating these valuations can take 2–4 months before the “Inventory” can even be filed.

- Unresolved Creditor Disputes: While the 6-month window is standard, if a creditor files a claim and the executor disputes it, the case must remain open until a judge rules on the validity of that debt.

Can Probate Be Completed Faster in Illinois?

Yes! Certain estates qualify for a faster probate process in Illinois:

- Independent Administration: If all heirs agree, the executor can settle the estate with minimal court involvement, allowing more flexibility, reducing delays.

- Small Estate Affidavit: If the estate is worth less than $150,000 and has no real estate, heirs may bypass probate entirely. (See 755 ILCS 5/25-1)

- Avoiding Probate with a Living Trust: If the deceased placed assets in a living trust, they pass directly to beneficiaries without probate.

Do You Have to Wait to Sell an Inherited House in IL After Probate?

No. A common misconception among heirs is that you must wait until the entire legal process is finished to liquidate real estate. While you certainly can wait to sell the house after probate is officially closed and the deed has been transferred to your name, doing so often results in months of unnecessary holding costs like property taxes, insurance, and utilities.

In Illinois, you do not always have to wait until the end. Once the court appoints an executor and issues “Letters of Office,” the estate can often sell the property during the probate process. This allows you to stop the financial bleeding sooner rather than waiting for the final distribution of assets.

Before you proceed, review the two primary strategies for selling your inherited property:

Fast Cash Offer

If the estate is facing immediate debt obligations, the property is in poor condition, or the beneficiaries require a fast settlement.

- Goal: Speed and Convenience

- Process: We can facilitate a quick, cash offer from our vetted network of trusted investors.

- Benefits: Close in 7-21 days, skip all repairs, no cleanout, quick way to turn the house into cash for the estate.

Maximized Market Sale

Best for estates that are financially stable, inherited properties in decent condition, or heirs prioritizing the highest possible profit.

- Goal: Highest possible net profit.

- Process: We help you list and sell the property quick on the open market

- Benefits: Close in 30-45 days, attract competitive market offers and maximize the sales price

Need to Sell a House During Probate in Illinois?

Don’t let the house become your biggest source of stress or delay in the probate process. Find out how much your inherited house could sell for.

FAQs About Probate Timeline in Illinois

How long does probate take in Cook County, Illinois?

Due to the volume of cases handled by the Cook County Probate Division at the Richard J. Daley Center in Chicago, the probate timeline often leans toward the longer end (12–18 months for a moderate estate). Uncontested estates are still subject to the mandatory 6-month creditor period, but expect slight delays in scheduling initial and final hearings due to the court’s high volume.

Is the probate timeline faster in DuPage County or Lake County, IL?

DuPage County and Lake County probate courts generally have slightly less congestion than Cook County. This means that if your estate is simple and uncontested, you may experience a quicker start to the process, potentially keeping your timeline closer to the 6-to-12-month range.

How long does probate take in Illinois if there’s a will?

If there’s a valid will and no disputes, probate usually takes 6 to 12 months.

How long does probate take in Illinois if there’s no will?

Without a will, probate follows Illinois intestacy laws, often making the process longer – typically 12 to 24 months.

Can you sell immediately, or wait to sell the house after probate is completed?

You generally do not have to wait to sell the house after probate is fully closed. In Illinois, once the court issues “Letters of Office,” the executor typically has the authority to list and sell the property while the estate is still open. Waiting until probate is completed often means paying unnecessary holding costs (taxes, insurance, utilities), so most estates choose to sell during the process to maximize the funds distributed to heirs.

Final Thoughts – How Long Does Probate Take?

Most Illinois probate cases take 6 to 12 months, while estates involving disputes or real estate sales may take two years or longer. Understanding the process and making informed decisions early can prevent unnecessary delays and expenses.

If you’re handling probate and need help selling an inherited home, our team can guide you through the process and help you determine the best path forward.