From filing to final distribution – how long can a probate case take?

Table of Contents

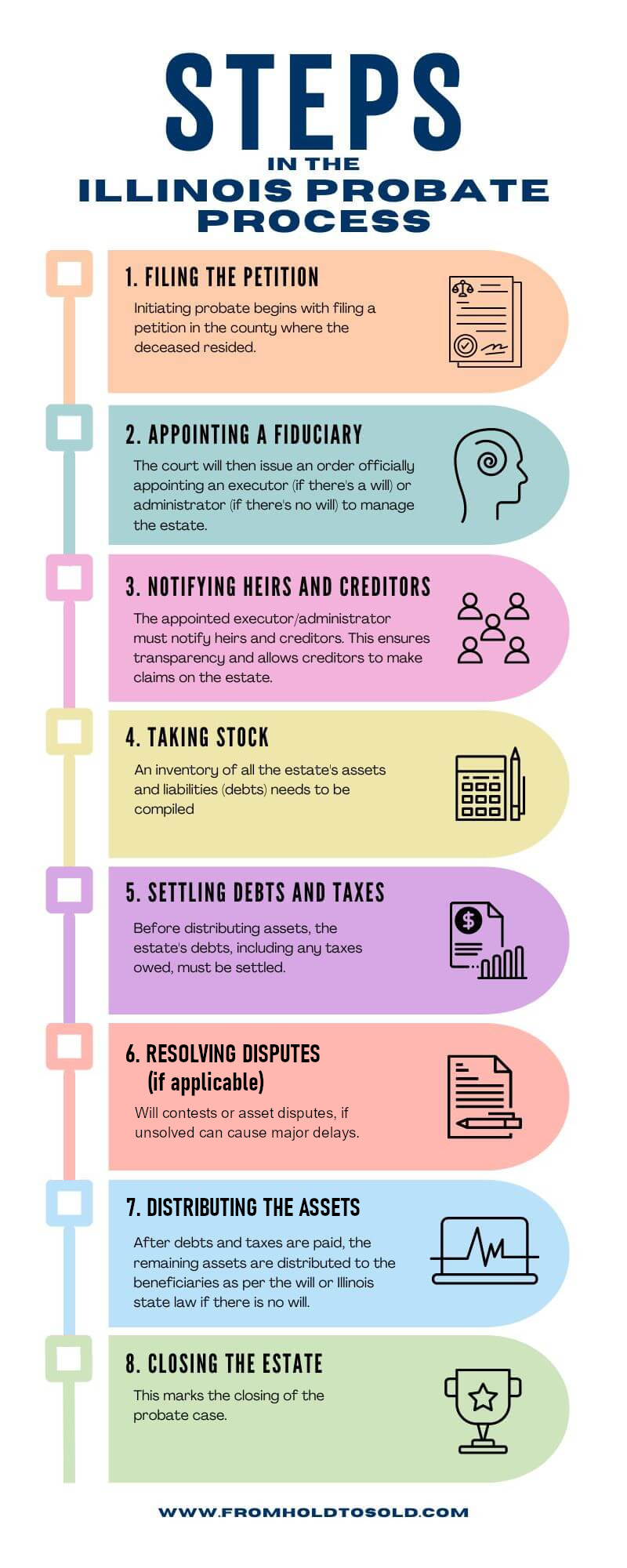

- A Step-by-Step Probate Timeline in Illinois

- 1. Filing the Probate Petition (1 to 4 months)

- 2. Appointing an Executor or Administrator

- 3. Notifying Heirs and Creditors (2 to 6 months)

- 4. Inventorying and Valuing Assets (2 to 6 months)

- 5. Paying Debts, Taxes, and Expenses (6 to 12 months)

- 6. Resolving Disputes (6+ months to several years, if applicable)

- 7. Distributing Assets & Closing the Estate (1 to 3 months)

- How Long Does Probate Take in Illinois?

- Can Probate Be Expedited?

- FAQs About Probate Timelines in Illinois

- Final Thoughts – How Long Does Probate Take?

If you’re asking, “How long does probate take?”, you’re not alone. Many executors and heirs find themselves navigating this complex legal process, wondering when they’ll be able to settle the estate and distribute assets.

In Illinois, probate can take anywhere from 6 months to over 2 years, depending on factors like estate size, creditor claims, and legal disputes. Some estates move quickly, while others face delays due to court backlogs, real estate sales, or contested wills.

In this guide, we’ll break down how long probate takes in Illinois, step by step, so you can better understand what to expect.

A Step-by-Step Probate Timeline in Illinois

1. Filing the Probate Petition (1 to 4 months)

The probate process starts when the executor (named in the will) or a family member (if no will exists) files a petition with the local county court. The court must validate the will and officially appoint the executor before probate can move forward.

Why this step takes time:

- Court backlogs can delay initial hearings for weeks to months.

- If the will is contested, the process can take longer.

2. Appointing an Executor or Administrator

Once you file the petition, the court will appoint a fiduciary—either an executor (if there’s a will) or an administrator (if there’s no will). This person is responsible for managing the estate throughout the probate process.

3. Notifying Heirs and Creditors (2 to 6 months)

Once probate is opened, the executor must notify heirs and creditors. Illinois law requires that:

- A legal notice is published in a local newspaper within 2 months.

- Creditors have at least 6 months to submit claims for unpaid debts.

Since creditor claims remain open for 6 months, this step alone can extend how long probate takes—even for simple estates.

4. Inventorying and Valuing Assets (2 to 6 months)

The executor must locate, document, and appraise all assets in the estate, including real estate, bank accounts, investments, valuables, and personal property.

Delays often happen if:

- Financial records are missing.

- Professional appraisals are required (especially for real estate or businesses).

For estates with multiple properties or business assets, this step can add months to the process.

Real-Life Example:

A recent client in Lake County faced a complex probate situation. The deceased owned a landscaping company, and before the heirs could settle the estate, the business assets had to be liquidated to satisfy creditors. This process took several months, delaying any action on the real estate. By the time they were ready to move forward, they needed a solution quickly. Once we got involved, we helped them list and sell the property efficiently, ensuring a smooth closing and allowing the heirs to finally settle the estate.

5. Paying Debts, Taxes, and Expenses (6 to 12 months)

Before any beneficiaries receive their inheritance, the estate must:

- Pay valid creditor claims.

- Settle outstanding debts, including mortgages or medical bills.

- File and pay any state and federal estate taxes (if required).

Disputed creditor claims can lead to legal battles and further slow probate and can extend the process by several months to over a year.

6. Resolving Disputes (6+ months to several years, if applicable)

If family members contest the will, disagree on asset distribution, or challenge the executor’s role, probate can take significantly longer.

Common reasons probate takes longer due to disputes:

- Family members contesting the will.

- Disagreements over the executor’s handling of assets.

- Multiple heirs fighting over real estate or personal property.

Disputes can add months—or even years—to the process.

7. Distributing Assets & Closing the Estate (1 to 3 months)

Once debts are paid, the executor submits a final accounting to the court for approval. After approval, remaining assets are distributed to heirs, and the court officially closes probate.

Delays in this step happen if:

- The court requires additional review or hearings before approving the final distribution.

- The estate includes real estate that must be sold before closing probate.

How Long Does Probate Take in Illinois?

The duration of probate varies based on estate complexity and whether disputes arise. Typical timelines are:

| Estate Type | Estimated Probate Duration |

|---|---|

| Simple estate, no disputes | 6 to 12 months |

| Moderate estate, some debts | 12 to 18 months |

| Complex estate, disputes | 18 to 24+ months |

The biggest factors affecting how long probate takes include:

- Independent vs. Supervised Probate – Independent probate is faster; supervised probate requires ongoing court involvement.

- Creditor Claims – If creditors contest payments, probate may take longer.

- Real Estate Sales – Selling a house in probate can add months to the timeline.

- Family Disputes – Will contests and legal battles can stretch probate years beyond the norm.

Can Probate Be Expedited?

Yes! Certain estates qualify for a faster probate process in Illinois:

- Independent Administration: If all heirs agree, the executor can settle the estate with minimal court involvement, allowing more flexibility, reducing delays.

- Small Estate Affidavit: If the estate is worth less than $100,000 and has no real estate, heirs may bypass probate entirely.

- Avoiding Probate with a Living Trust: If the deceased placed assets in a living trust, they pass directly to beneficiaries without probate.

FAQs About Probate Timelines in Illinois

How long does probate take in Illinois if there’s a will?

If there’s a valid will and no disputes, probate usually takes 6 to 12 months.

How long does probate take in Illinois if there’s no will?

Without a will, probate follows Illinois intestacy laws, often making the process longer—typically 12 to 24 months.

Can probate in Illinois be expedited?

Some estates qualify for independent administration or a Small Estate Affidavit, which speeds up the process.

Final Thoughts – How Long Does Probate Take?

So, how long does probate take in Illinois? The answer depends on the estate’s complexity, the presence of disputes, and whether the executor follows the proper steps. While some estates wrap up in 6 to 12 months, others may take 2+ years due to court delays, creditor claims, or legal challenges.

If you’re handling probate and need help selling an inherited home, I can guide you through the process. Whether you need a fast sale or assistance navigating probate requirements, I’m here to help.