What It Means for Rising Property Taxes and Your Options as a Homeowner

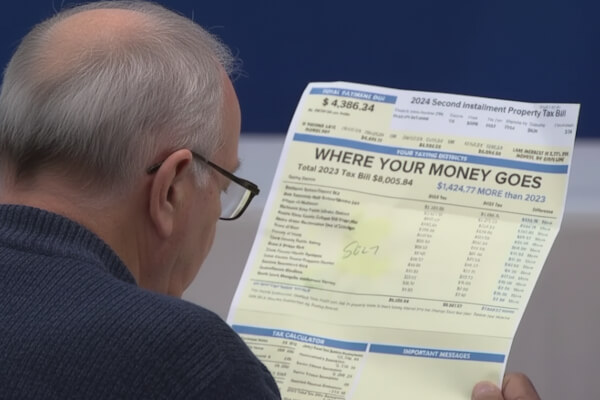

Property taxes in Cook County have climbed steeply in recent years, leaving many homeowners struggling to keep up. For households already balancing mortgages, insurance, and upkeep, the added pressure of skyrocketing tax bills has turned homeownership into a financial burden.

In response, Cook County has launched a $15 million Homeowner Relief Fund in 2025. The program offers a one-time $1,000 payment to qualifying households facing the steepest tax increases. While the initiative provides short-term help, it does little to address the bigger problem: property taxes that continue to rise year after year.

This article explains what the Cook County Homeowner Relief Fund is, who qualifies, how to apply, and its limitations. We’ll also look at other ways to reduce your tax bill – and what to consider if selling your home is ultimately the best way forward.

Table of Contents

- 1. Understanding the Cook County Homeowner Relief Fund

- 2. Eligibility Requirements for the Homeowner Relief Fund

- 3. How to Apply for the Cook County Relief Fund

- 4. Limitations of the Relief Fund

- 5. Other Ways to Reduce Cook County Property Taxes

- 6. When Selling Your Home May Be the Best Option

- 7. Action Plan for Cook County Homeowners

- 8. Conclusion

1. Understanding the Cook County Homeowner Relief Fund

The Homeowner Relief Fund (HRF) was created to give Cook County residents temporary financial breathing room as part of broader property tax reform discussions.

- Fund size: $15 million

- Individual relief amount: $1,000 one-time payment

- Deadline to apply: October 10, 2025, at 11:59 p.m.

- Administration: Managed by AidKit, Inc., a third-party partner contracted by the County to handle applications, verification, and distribution

County officials estimate that the program can support approximately 14,000 households. However, more than 100,000 Cook County homeowners may meet the eligibility requirements, which means not everyone will receive funding.

The County has signaled that this is a stopgap measure, not a long-term fix. Larger-scale reforms, such as changes to assessment practices and property tax appeals, remain in discussion.

2. Eligibility Requirements for the Homeowner Relief Fund

To qualify for the Cook County Homeowner Relief Fund, applicants must meet several requirements:

Significant Tax Increase

One of your property tax bills for 2021, 2022, or 2023 must show at least a 50% increase compared to the prior year. Even small properties or households that previously paid little in taxes can qualify if their increase meets this threshold.

Income Requirements

Household income must be at or below 100% of the Area Median Income (AMI) for Cook County. As of 2025, this means:

- 1-person household: up to $83,700

- 4-person household: up to $119,900

Owner-Occupied Property

The property must be your primary residence. Investment properties, second homes, or rental units are not eligible.

Lottery-Based Distribution

Because demand is expected to exceed the available funds, qualified applicants will be entered into a lottery system. Selection is not guaranteed, even if you meet all criteria.

3. How to Apply for the Cook County Relief Fund

The application process is straightforward but requires careful preparation:

Step 1: Submit Your Application

Visit the official portal: Cook County HRF Application. Enter your household information, property identification number (PIN), and income details.

Step 2: Document Verification

If selected, you’ll need to upload documentation to confirm your eligibility. This typically includes:

- Recent property tax bills (2021–2023)

- Proof of residence (driver’s license, state ID, or utility bill)

- Proof of income (tax return, W-2, or recent pay stubs)

Step 3: Relief Payment

Once documents are verified, AidKit, Inc. will distribute the $1,000 payment. Payments are expected to be processed in late 2025.

📅 Important: The application window closes on October 10, 2025. Missing the deadline means losing the opportunity to be considered.

4. Limitations of the Relief Fund

While the relief program is welcome, homeowners should understand its limitations:

- One-time payment: The $1,000 assistance does not recur.

- Limited reach: Only about 14,000 households will receive funds, leaving many without support.

- Lottery system: Meeting eligibility requirements does not guarantee payment.

- Insufficient coverage: For homeowners whose property taxes have increased by thousands of dollars, $1,000 provides only partial relief.

In short, the program may help you pay part of a bill or buy time, but it is not a long-term solution.

5. Other Ways to Reduce Cook County Property Taxes

Even if you qualify for the relief fund, you should explore other avenues to reduce your property tax burden.

File for Exemptions

Cook County offers several exemptions that can significantly lower your taxable assessed value:

- Homeowner Exemption for owner-occupied properties

- Senior Citizen Exemption and Senior Freeze for qualifying seniors

- Disabled Persons and Veterans Exemptions

If you missed claiming exemptions in previous years, you may still be able to apply retroactively through a Certificate of Error.

File an Assessment Appeal

If you believe your property’s assessed value is too high, you can:

- File an appeal with the Cook County Assessor’s Office

- Appeal further with the Cook County Board of Review or the Illinois Property Tax Appeal Board (PTAB)

Explore Payment Plans and Deferrals

The Cook County Treasurer’s Office offers installment plans and, in some cases, deferrals for qualifying seniors or veterans. These options can make taxes more manageable, even if they don’t lower the bill.

6. When Selling Your Home May Be the Best Option

For many homeowners, even exemptions, appeals, and relief programs may not be enough. If taxes have made your home unaffordable, selling may be the most practical way to move forward.

Signs You Should Consider Selling

- Property taxes continue to rise faster than your income

- You are falling behind on payments or dipping into savings

- Relief programs are not enough to offset long-term costs

Selling Options

- Traditional Sale: Can bring top dollar if the property is market-ready.

- As-Is Sale: Useful if the home needs repairs or updates; investors or developers may be interested.

- Hybrid Strategy: Market the home both as a primary residence and as a redevelopment opportunity to attract multiple buyer types.

We specialize in guiding Cook County homeowners who feel “stuck” with their property. Whether you want to sell quickly, list for maximum value, or explore multiple strategies, we help you make an informed decision. Click the button below to connect with one of our agents.

7. Action Plan for Cook County Homeowners

- Check eligibility for the Homeowner Relief Fund.

- Apply before October 10, 2025.

- Gather documents to avoid delays.

- Claim exemptions and file appeals if possible.

- Consider selling if taxes make your home unaffordable.

- Schedule a consultation with a trusted real estate professional to explore your options.

8. Conclusion

The Cook County Homeowner Relief Fund provides short-term assistance for homeowners facing sharp tax increases. While $1,000 is better than nothing, it will not solve the ongoing challenge of rising property taxes in the region.

For many, long-term solutions lie in exemptions, appeals, or making the tough choice to sell. Our team helps Cook County homeowners navigate these challenges and move forward with confidence.

👉 Contact us today for a free consultation to discuss whether tax relief, an appeal, or selling your home is the best path for your situation.